types of tax in malaysia

There are a number of different types of DIY SEO software available each with its own set of features and benefits. Heres How A Tax Rebate Can Help You Reduce Your Tax Further.

If you are looking for VIP Independnet Escorts in Aerocity and Call Girls at best price then call us.

. If Marks German tax liability on the 13500 is 1500 once converted from EUR the foreign tax credit of 200 will reduce his German liability. The taxation of dividends in. TAX HAVEN -- Tax haven in the classical sense refers to a country which imposes a low or no tax and is used by corporations to avoid tax which otherwise would be payable in a high-tax country.

TAX-FREE ZONE -- Area within the territory of a country in which customs duties and other types of indirect taxes are not applied. According to OECD. The empty string is the special case where the sequence has length zero so there are no symbols in the string.

Rate Business trade or profession Employment Dividends Rent. People who choose to do business in Malaysia can benefit from the interesting opportunities on the market and from the incentives and advantages that come with the taxation system in the country. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid.

It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer. The double tax treaty tells Mark that the UK has the main right to tax the income and that if Germany also wants to tax it then the foreign tax credit method should be used to avoid double tax. Non-residents are subject to withholding taxes on certain types of income.

Malaysia used to have a capital gains tax on real estate but the tax was repealed in April 2007. Lembaga Hasil Dalam Negeri Malaysia classifies each tax number by tax typeThe most common tax reference. With Gseo being by far the most cost efficient.

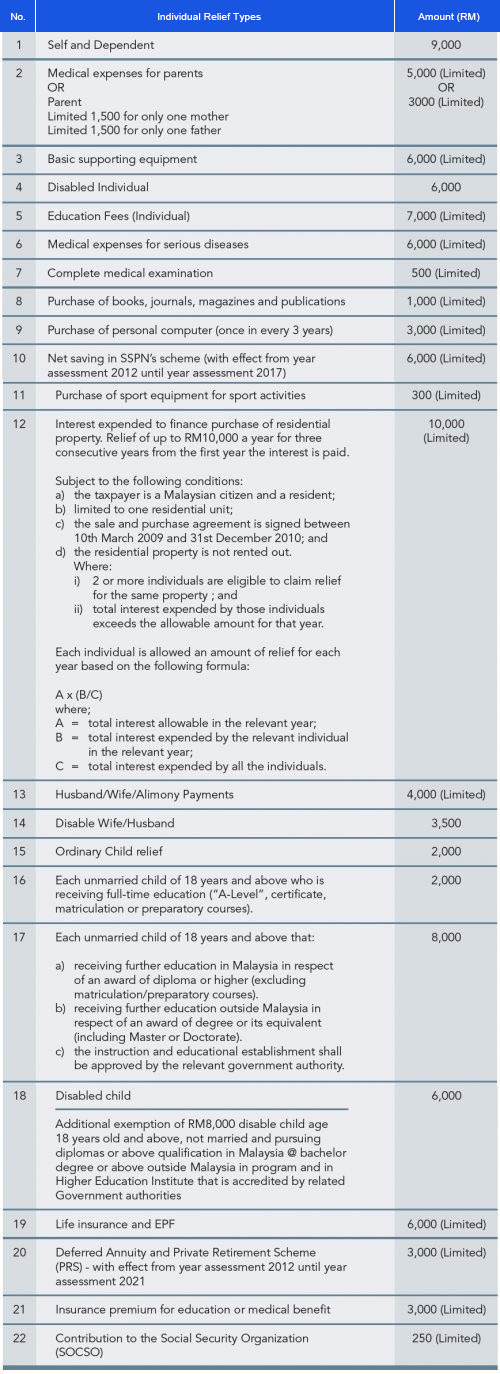

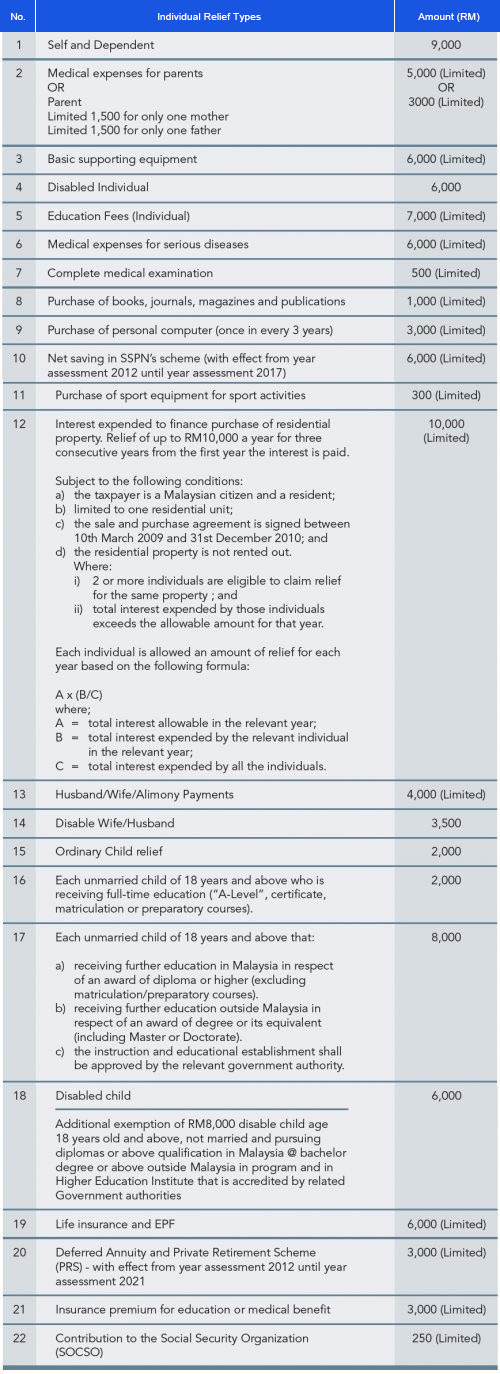

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. These Are The Personal Tax Reliefs You Can Claim In Malaysia. There are 3 categories of business entity registration namely Registration of Business ROB Registration of Company ROC and Limited Liability of Partnership LLP.

This section explains the payment types their definition and withholding tax applied. Games available in most casinos are commonly called casino gamesIn a casino game the players gamble cash or casino chips on various possible random outcomes or combinations of outcomes. Find Out Which Taxable Income Band You Are In.

Plan for your future today. In different parts of the world a marketplace may be described as a souk from the Arabic bazaar from the Persian a fixed mercado or itinerant tianguis or palengke PhilippinesSome markets operate daily and are said to be. Contract payments to NR contractors.

Tax revenue as percentage of GDP in the European Union. For instance it is good to know that the dividends of companies in Malaysia are not taxed which is why shareholders can enjoy the 100 share profit. An Income Tax Number or Tax Reference Number is an unique identifying number used for tax purposes in Malaysia.

How Does Monthly Tax Deduction Work In Malaysia. Any work or professional service performed or rendered in Malaysia in connection with or in relation to any undertaking project or scheme carried on in Malaysia are deemed to be services under contract. If a Malaysian or foreign national knowledge worker resides in the Iskandar Development Region and is employed in certain qualifying activities by a designated company and if their employment commences on or after 24 October 2009 but not later than 31 December.

Gseo DIY SEO software is a great way to get started with SEO. Sales and Service Tax Malaysia Airlines Berhad Reg. Learn the specific estate planning documents you need to protect yourself and your loved ones.

The Inland Revenue Board of Malaysia Malay. Registering a business entity with the Companies Commission of Malaysia SSM is the first requirement to run a business legally in Malaysia. As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5 specific rates and others are specifically exempt.

Types of Income. An individual retirement account IRA in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. Other income is taxed at a rate of 30.

It is also commonly known in Malay as Nombor Rujukan Cukai Pendapatan or No. An individual retirement account is a type of individual retirement arrangement as. The tax percentage for each country listed in the source has been added to the chart.

Some of the most popular options include GseoMoz SEMrush and Ahrefs. A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally. Compare hotel deals offers and read unbiased reviews on hotels.

Aerocity Escorts 9831443300 provides the best Escort Service in Aerocity. 30 Public entertainer. Sales tax is charged by registered manufacturers of taxable goods and on the importation of taxable goods into Malaysia.

Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Formally a string is a finite ordered sequence of characters such as letters digits or spaces. Enjoy a Bonus Side Trip to West Malaysia Bangkok or Singapore where the flight is on us you just pay the taxes.

Casino games are also available in online casinos where permitted by lawCasino games can also be played outside casino for entertainment purposes like in parties or in. Get the latest science news and technology news read tech reviews and more at ABC News. Not all types of assets are capital assets.

Relation between the tax revenue to GDP ratio and the real GDP growth rate average rate in years 20132018 according to List of countries by real GDP growth rate data mainly from the World Bank. An audit is an objective examination and evaluation of the financial statements of an organization to make sure that the records are a fair and accurate representation of the transactions. It is a trust that holds investment assets purchased with a taxpayers earned income for the taxpayers eventual benefit in old age.

A marketplace or market place is a location where people regularly gather for the purchase and sale of provisions livestock and other goods. Free press release distribution service from Pressbox as well as providing professional copywriting services to targeted audiences globally. However a real property gains tax RPGT has been introduced in 2010.

Meanwhile for the B form. How Does DIY SEO Software Work.

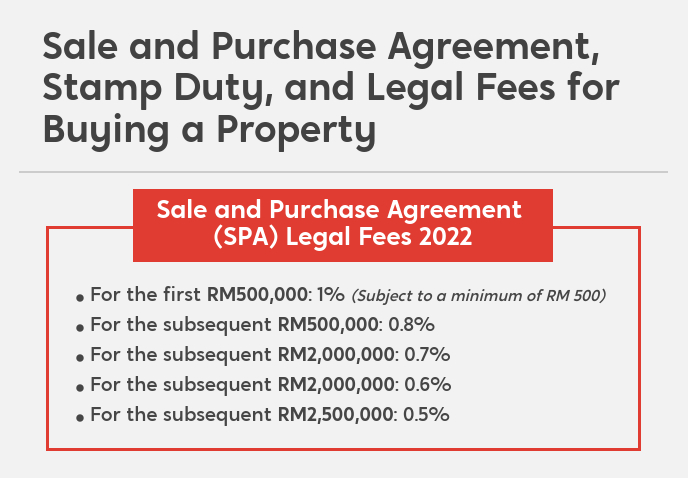

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Solved Required Discuss In Detail All The Various Types Of Chegg Com

Wondering Why You Re Taxed A Lot Here S Why Nocturnal

Pdf Tax Simplicity And Small Business In Malaysia Past Developments And The Future Semantic Scholar

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Malaysia Personal Income Tax Guide 2020 Ya 2019

What Is Direct Tax Indirect Tax Types Differences Between Direct Tax Indirect Tax Explained Youtube

Understanding Tax Smeinfo Portal

Pdf The Shadow Economy In Malaysia Evidence From An Ardl Model Semantic Scholar

Individual And Corporate Tax Reform

Malaysia Achieves Record Direct Tax Collection Of Rm137b In 2018 The Edge Markets

Why It Matters In Paying Taxes Doing Business World Bank Group

Types Of Taxes In Malaysia For Companies

Updated Guide On Donations And Gifts Tax Deductions

:max_bytes(150000):strip_icc()/FormW-8BEN-E-414e383aa32d41d0bb6d9095f4861541.jpeg)

W 8ben When To Use It And Other Types Of W 8 Tax Forms

Malaysia Personal Income Tax Guide 2021 Ya 2020

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Comments

Post a Comment